Mortgage Brokers Upper Ferntree Gully

We make Upper Ferntree Gully home loans easy.

Our local mortgage brokers are here to help you with your home loan, construction loan, your first home loan or refinancing.

Connect With Our Local Brokers

We've received your message - thank you. One of our local home loan experts will get back to you as soon as possible.

Oops, there was an error sending your message. Please try again later or call us on 📞 0423 713 362 if you need help.

Chat with our expert mortgage brokers, our services are completely free

Led by much loved local mortgage broker, Jacob Decru, we will help you find some of the industry's best rates and navigate the entire application process - to make everything easy and stress-free. We make buying a Upper Ferntree Gully

home or investment property easy, so please don't hesitate to get in touch.

We've helped thousands of locals get better home loans.

Meet a few Upper Ferntree Gully clients below.

How can our mortgage brokers Upper Ferntree Gully team help?

First Home Loans

Our Upper Ferntree Gully Mortgage Broker team help make the entire process easier and hassle free for first home buyers.

Changing Home Loans

Upgrading, downgrading or side-grade homes and need help? Our local Mortgage Broker team can help!

Home Loan Refinancing

Need better rates or have a change in circumstances? Our Upper Ferntree Gully Mortgage Broker team can help.

Construction Financing

Construction projects can present many challenges. Our local team help remove the financial unknowns.

Instead of one lender, we compare 60+ leading lenders for you

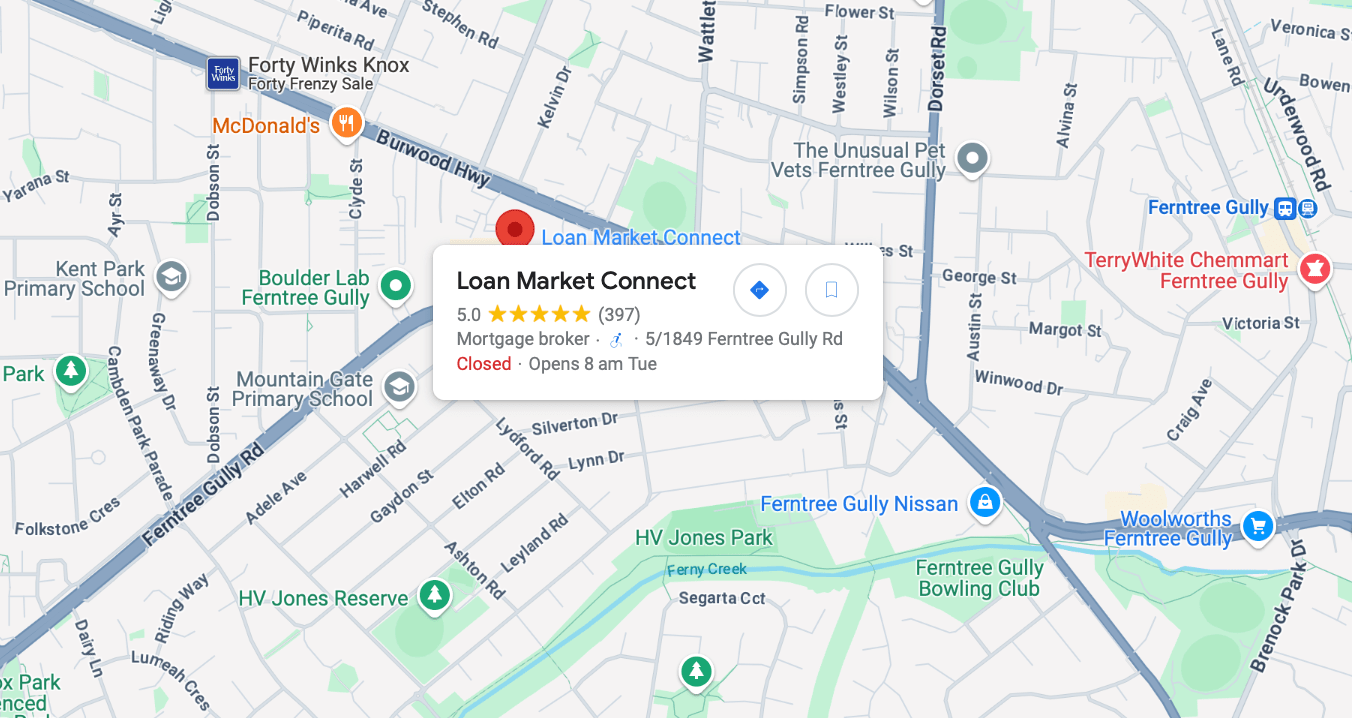

Prefer to visit our offices? Simply schedule a time

Dropping in for a cup of coffee can always help to get to know our local mortgage brokers a little better, or we can meet at a coffee shop near you.

This is our office address:

1038A Dandenong Rd, Carnegie VIC 3163

Let's make a time 📞

0423 713 362

"Who" do our local Mortgage Brokers Upper Ferntree Gully help?

Upper Ferntree Gully First Home Buyers

Finding the perfect first home can be daunting, and that's before you walk into a single bank for pre-approval or starting the home loan application process. That's why we think you’ll love our simple, expert advice from our local mortgage broking company, we help make the entire process hassle-free. Just contact our expert Mortgage Brokers Upper Ferntree Gully team or call Jacob Decru on 0423 713 362.

Upper Ferntree Gully Home Buyers

If you're looking to upgrade, downgrade or side-grade your Upper Ferntree Gully home, and need financing or refinancing, chat to our local team about how we've helped others transition seamlessly with market-leading loan rates, all without having to deal with the major banks or others in the lending industry. If you know the lending process, we can simply be your negotiation team or let our experienced team help you with a loan health check.

Upper Ferntree Gully Investment Buyers

When we look at the Upper Ferntree Gully property market, of course not all properties or blocks of vacant land are great investments, and often to get the best returns, you'll need to have the right mortgage consultants who know the local area. As local investors ourselves and independent mortgage brokers, our team of mortgage agents can help you get financing for your first, or fifth investment property. Just get in touch with Jacob Decru today on 0423 713 362.

Upper Ferntree Gully Home Refinancing

Have your circumstances changed, maybe a new job or addition to the family? Or are you looking to start those long-awaited renovations on your home? Lots of people refinance for different reasons, and it's an exciting opportunity to create new spaces in your home. Let our loan specialists provide honest advice and help you get competitive rates. We can also point you to our brilliant free online mortgage calculators so you can see what extra payments look like.

Upper Ferntree Gully Construction Financing

Even with the best plans and project managers, building a new home or starting a major construction project in Upper Ferntree Gully can present many unknown challenges. This is where mortgage broking experience really counts, and with our combined experience and simple loan process for domestic and commercial property, we can help you remove the financial unknowns and play a pivotal role in your construction project or help you refinance loans with the right finance solutions.

Upper Ferntree Gully Self-Employed People

People with non-traditional income sources, like self-employed individuals, business owners or freelancers, might need specialised assistance in finding mortgage options that consider their income structure and individual situation. This is where our highly experienced, licensed mortgage broker team can help, from home loans to commercial loans. Jacob and his team truly understand the challenges self-employed people face, so just get in touch with Jacob Decru today on 0423 713 362 if you are self-employed.

Upper Ferntree Gully Clients with Unique Financial Situations

Mortgage brokers can help clients with unique financial circumstances, such as those with a history of poor credit or irregular income, where for example, other lending institutions have knocked you back. We have a track record and have access to hundreds of mortgage products, and can often find a lender who are willing to work with you, and provide the mortgage services you need. This is also where Jacob and his team who have in-depth banking and experience in finance really shine!

"How" do our expert Upper Ferntree Gully Mortgage Advisors help?

Jacob Decru and his team are the experts at making you home loans easy - and we do the heavy lifting for you. That's why we have loads of amazing 5-star reviews from our Upper Ferntree Gully clients. The team here can help you in several ways, from pre-approval to mortgage insurances and more, we're happy to go the extra mile to get your mortgage approval.

1. Home Loan Financial Assessment

Mortgage brokers typically start by assessing your financial situation, whether your a first home buyer or buying your fifth investment property. This includes analysing your assets, income, expenses, credit history, and overall financial readiness using responsible lending questionnaires and the like, to determine how much you can afford to borrow with the various loan types available. At this stage, we can also provide unofficial financial advice and credit advice to get your on track, if you need it. Our goal is long-lasting relationships with our clients, so you call us for your next home too!

2. Mortgage Pre-Approval Process

Brokers like Jacob Decru Mortgage Agents help you get a fast pre-approved for a mortgage, and understand every loan process step in detail. Our job involves working with over 60 lenders to obtain a conditional approval for a loan amount, which can give you a clearer idea of their budget when house hunting.

3. Local Upper Ferntree Gully Market Knowledge

Local mortgage brokers often have a good understanding of the Upper Ferntree Gully real estate market. We can provide insights into property values, trends, and neighbourhoods, helping you make more informed decisions.

4. Comparison Shopping

Brokers can save time for first home buyers, all the way to savvy investors by comparing loans and finance options from multiple lenders. This can help buyers find competitive interest rates and favourable loan terms for your borrowing power. Having a range of options is key when you are looking at lending solutions, including commercial lending. Be sure to get in touch with Jacob Decru today on 0423 713 362 if you have any questions.

5. Paperwork and Application

Mortgage brokers like Jacob Decru's team assist with the preparation and submission of mortgage applications, and that's what makes our range of services so valuable. We can help you gather the necessary documents and ensure that the application is completed accurately and promptly, to help you reduce the stress and time it takes to finance your home or renovations.

6. Negotiation

Experienced brokers like Jacob Decru are here to negotiate with lenders on your behalf, in order to secure the best possible terms for your mortgage. No matter if you're a first home buyer in Upper Ferntree Gully, or buying your fifth investment property, we're industry experts who can help.

7. Simplifying the Process

Buying a home involves complex paperwork and processes. Mortgage brokers like Jacob Decru can simplify the process by guiding you through each step and answering any questions you may have. From pre-approval, finding the most competitive market rates, accessing your current lender, performing the best mortgage comparisons around, our award-winning mortgage services is why we have so many 5-star Google review. Just get in touch with Jacob Decru today on 0423 713 362 if you’ve any questions, big or small.

8. Continued Support

A mortgage broker's assistance doesn't end after your mortgage is approved. Jacob and his Upper Ferntree Gully mortgage broker team continue to offer support, answer questions, and help with any issues that arise during the settlement process or during loan repayments, such as regularly checking in or looking into refinancing for the best rate home loans, with genuine and bespoke finance home loan advice if your situation changes.

Why is Upper Ferntree Gully 3156 a great place to buy a home or investment property?

Upper Ferntree Gully, located in the eastern suburbs of Melbourne, is considered a great place to buy a home or investment property for several reasons:

* Scenic Environment: Upper Ferntree Gully is surrounded by the stunning Dandenong Ranges National Park, offering a picturesque backdrop and plenty of greenery.

* Transportation: The suburb is well-connected, with a train station on the Belgrave line providing easy access to the city. There are also bus services and major roads nearby.

* Schools: There are several schools in the area, making it attractive to families. Schools like Upper Ferntree Gully Primary School and Upwey High School are well-regarded.

* Recreation: Residents can enjoy outdoor activities in the national park, including hiking, biking, and picnicking. The suburb also has parks, sports facilities, and community centers.

* Community Feel: Upper Ferntree Gully has a strong community spirit, with local events, markets, and community groups bringing residents together.

* Property Prices: While property prices have been rising, they are generally more affordable compared to some other Melbourne suburbs, making it attractive for buyers and investors.

* Development Potential: With ongoing infrastructure projects and development in the area, there may be opportunities for property value growth in the future.

Overall, Upper Ferntree Gully offers a balance of natural beauty, convenience, and community amenities, making it a desirable place to live or invest.

Just get in touch with Jacob and the team on 0423 713 362 if you are comparing lenders or need pre-approval.

Who are the major home loan lenders in the Upper Ferntree Gully 3156 area?

When it comes to securing a Upper Ferntree Gully home loan, there are several major lenders including Australian banks and financial institutions who operate in the region with an overwhelming amount of financial products that aren't always easy to understand. These lenders all offer a wide range of loan products based on your borrowing capacity. Here are some of the major home loan lenders you could consider:

1. Mortgage Brokers

Did you know that 70% of Australians now use a Mortgage Broker over a bank? A Mortgage Advisor like the team at Jacob Decru Mortgage Brokers is really the easiest way to go, no matter what mortgage companies you are talking with, brokers like Jacob Decru work for you, not the banks - and can help you quickly understand the types of loans available, and those that best suit your unique needs.

Just contact our local Upper Ferntree Gully team, we can help look at your overall finance journey, and work with over 60 lenders to find the right solution and provide helpful advice. We work with both traditional banks and alternative options, to find the best home loan for your needs.

Other Mortgage Brokers and finance brokers include Aussie Home Loans, Mortgage Choice, Loan Market, Smartline Mortgage Advisers, Mortgage Express, Lendi and more.

2. Major Banks

Australia's major banks like Commonwealth Bank, Westpac Bank, ANZ Bank, and National Australia Bank (NAB) offer a range of home loan products and personal loans. These banks have a significant presence in the local Upper Ferntree Gully area and throughout Australia.

3. Non-Bank Lenders

Non-bank lenders without a physical office includes the likes of ING, ME Bank, Macquarie Bank and more, who might offer alternative home loan options and could be worth considering.

Just get in touch with Jacob and the team on 0423 713 362 if you are comparing lenders, we have years of experience in the Melbourne property and mortgage market.

Researching home loans?

Just call us on 📞 0423 713 362

JACOB DECRU & OUR TEAM

We're LM Connect, run by Jacob Decru, your local Mortgage Brokers Melbourne and part of the Loan Market Connect team. You can also contact us here: connect@loanmarket.com.au

Our main Melbourne office:

1038A Dandenong Rd, Carnegie VIC 3163

USEFUL LINKS

All Rights Reserved. SEO by Copyburst